Breakout Chart Patterns December 10

A price pattern is a recognizable configuration of price movement identified using a series of trendlines and/or curves. When a price pattern signals a change in trend direction, it is known as.

an image of price chart breakout patterns

Breakout chart patterns are the last phase that stocks go through. First there is the oversold pattern, next the continuation pattern, and then the breakout chart pattern. Traders that bought on the oversold pattern and continuation pattern often take profits on the breakout chart pattern.

How To Trade Breakout Stocks

A breakout stock is simply one that has a quick (and often short-lived) period of volatility, either to the upside or downside. Most traders consider a breakout to be a bullish trend, but.

Breakout Chart Patterns & Trend lines A Practical Book PDF Free Download

A rectangle is a chart pattern formed when the price is bounded by parallel support and resistance levels. A rectangle exhibits a period of consolidation or indecision between buyers and sellers as they take turns throwing punches but neither has dominated.

Chart Patterns Cheat Sheet [FREE Download]

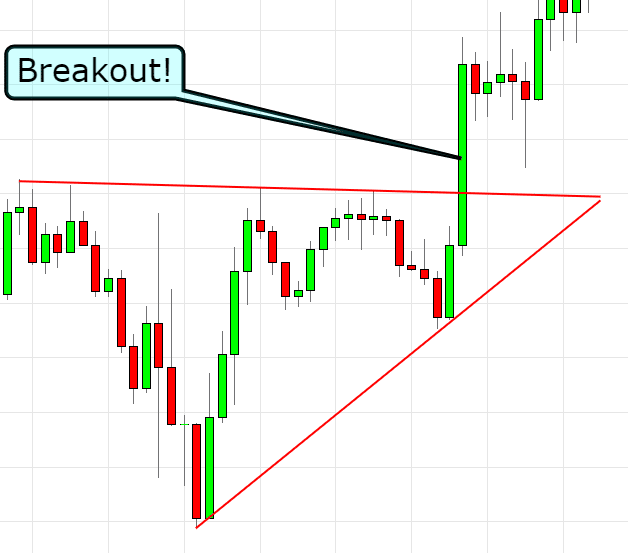

Breakouts are commonly associated with ranges or other chart patterns, including triangles, flags, wedges, and head-and-shoulders. These patterns are formed when the price moves in a.

How to trade breakout. Breakout patterns for OANDAEURUSD by DeGRAM — TradingView

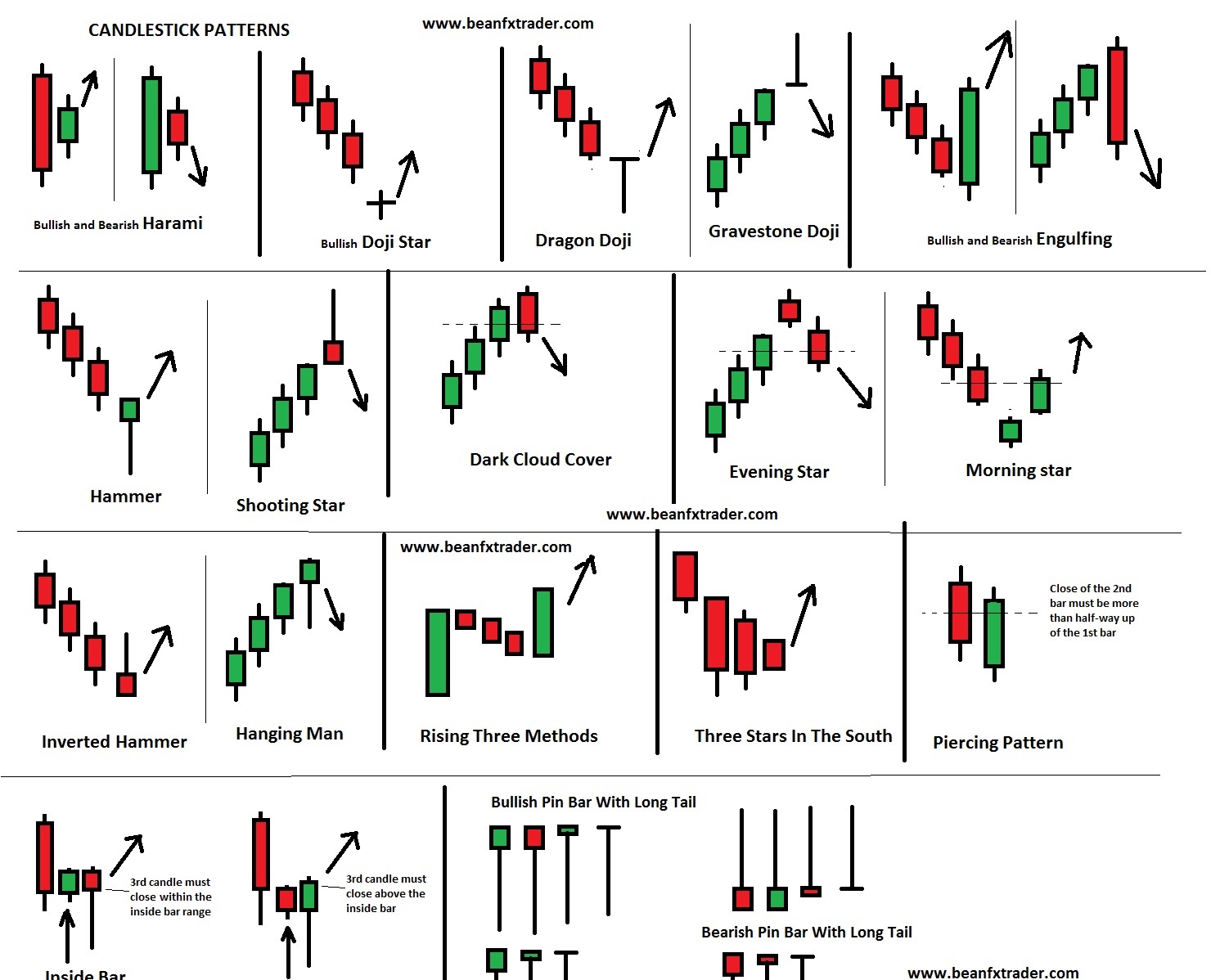

A pattern is bounded by at least two trend lines (straight or curved) All patterns have a combination of entry and exit points Patterns can be continuation patterns or reversal patterns Patterns are fractal, meaning that they can be seen in any charting period (weekly, daily, minute, etc.)

The Best Breakout Trading Strategy Trade Room Plus

Cup and handle pattern Rectangles Summary Why trade breakouts? Breakouts play an important role in the market both for investors and traders. They are useful for two main reasons. First, a new trend usually emerges after the breakout happens.

Analyzing Ascending Triangle Chart Patterns

Breakout patterns can occur when a stock has been trading in a range. The top of the range is resistance, and the bottom is support. If the stock breaks through either end of this range, it's a breakout. When it breaks above resistance, we call it a breakout. Below support is a breakdown. Learn more about breakout trading here.

Trendline Breakout Strategy FX & VIX Traders Blog

This target price of $25 is calculated by taking the height of the pattern of $2.60 ($22.40 - $19.80) and adding it to the entry price of $22.40. Image by Sabrina Jiang © Investopedia 2021 You.

Breakout Trading Pattern Strategy Learn This Simple Strategy!

These patterns can mark reversal breakouts or continuation breakouts. The chart above shows Corning (GLW) with a reversal Quadruple Top Breakout in February 2009. This reversal pattern also resembles an inverse head-and-shoulders. The second Quadruple Top Breakout is a bullish continuation pattern.

Triangle Chart Patterns Complete Guide for Day Traders

A breakout pattern is formed when the price of an asset breaks through a significant level of support or resistance on the chart. It occurs when buying or selling pressure becomes strong enough to overcome the prevailing price range, resulting in a breakout and potential continuation of the price movement.

Page 348 12 — Education — TradingView

INTRODUCTION This is a short illustrated 10-page book. You're about to see the most powerful breakout chart patterns and candlestick formations, I've ever come across in over 2 decades. This works best on shares, indices, commodities, currencies and crypto-currencies. By the end you'll know how to spot:

How To Avoid False Breakouts 5 Key Tips You Should Definitely Know

The 4 Best Breakout Chart Patterns 15th Jul '21 by Jack Corsellis 8 comments 1926 reads This report illustrates my 4 preferred charts patterns to identify before a breakout.

:max_bytes(150000):strip_icc()/dotdash_Final_Breakout_Definition_and_Example_Nov_2020-01-0143a5a8cd1a4fbd9433afe51482d6ea.jpg)

Breakout Definition and Example

Breakout candlestick patterns are essential tools for traders who are looking to capitalize on significant price movements. These patterns provide valuable insights into the market's sentiment, and when combined with other technical analysis techniques, they can be powerful indicators of upcoming price breakouts. Mastering the identification and interpretation of breakout candlestick.

Technical Stock Chart Patterns Cheat Sheet Stock chart patterns, Stock trading strategies

A breakout is a potential trading opportunity that occurs when an asset's price moves above a resistance level or moves below a support level on increasing volume. The first step in trading.

Triangle Chart Patterns Complete Guide for Day Traders

A breakout trader enters the market long or short when the stock price breaks above resistance or below support. When a stock trades over a price barrier, volatility rises, and prices usually move in the breakout direction.